Overview of Growth, Income, and Market Neutral Solutions for Your Clients

Are you seeking general information about Income, Growth, and Market Neutral alternative investments to share with your clients? Here are the general differences between the three alternative investment solutions:

- Income investments focus on generating a steady income stream through assets like bonds, dividend-paying stocks, or real estate investment trusts (REITs).

- Growth investments aim to maximize capital appreciation by investing in high-growth potential companies.

- Market-neutral alternative investments, on the other hand, aim to achieve positive returns regardless of market conditions.

Read on to learn about a few investment strategies and how they can fit into a well-diversified portfolio.

Growth-Oriented Alternative Investments:

Venture Capital: Investing in early-stage companies with high growth potential. Offers substantial returns but comes with high risk due to the uncertainty of startup success.

Private Equity: Investing in non-publicly traded companies. Can provide strong returns through company growth, operational improvements, and eventual exit strategies.

Hedge Funds: These funds aim for high returns by utilizing various strategies (long/short, derivatives, leverage). They can be riskier due to their complex strategies and higher fees.

Income-Oriented Alternative Investments:

Real Estate Investment Trusts (REITs): Private REIT solutions and credit solutions are other real estate property investments that generate income through rent. Offers stable dividends and potential for capital appreciation.

Market Neutral-Oriented Alternative Investments:

Long / Short Equity Funds: These funds combine long positions in stocks expected to rise and short positions in stocks expected to decline. Aim to provide returns uncorrelated to the overall market.

Convertible Arbitrage: Investing in convertible securities and hedging the equity exposure. Seeks to benefit from price discrepancies between the convertible securities and the underlying stock.

Merger Arbitrage: Profiting from price differentials of companies involved in mergers or acquisitions. Requires thorough analysis of deal completion probabilities.

Alternative Investments Comparison

| Criteria |

Growth |

Income |

Market Neutral |

| Investment Examples |

Venture Capital, Private Equity, Hedge Funds, Cryptocurrencies |

REITs, MLPs, P2P Lending, Dividend Stocks |

Long/Short Equity Funds, Convertible Arbitrage, Statistical Arbitrage, Merger Arbitrage |

| Goal |

Maximize capital appreciation through high-growth potential |

Generate regular income and potential for capital appreciation |

Achieve returns with a low correlation to the broader market |

| Risk Level |

High |

Moderate to High |

Moderate to High |

| Potential Returns |

High |

Moderate to High |

Moderate to High |

| Investment Horizon |

Long-term |

Medium to Long-term |

Short to Medium-term |

| Main Risks |

Startup failure, market volatility, illiquidity |

Interest rate risk, default risk, real estate market fluctuations |

Market volatility, mispricings, deal failure risk |

| Tax Considerations |

Variable tax treatment depending on the investment type |

Dividend taxation, MLP tax complexities |

Tax implications of short-term trading and arbitrage |

| Liquidity |

Often low due to the nature of investments |

Varies depending on the investment type |

Varies depending on the investment type |

| Investment Complexity |

High due to early-stage company analysis, complex strategies |

Moderate, with some investments requiring an understanding of real estate or energy sectors |

Moderate to High, involving sophisticated strategies |

| Diversification Benefits |

Potentially diversifies traditional portfolio |

Can provide income stream diversification |

Offers diversification from traditional market exposure |

| Examples of Returns |

Potential for 10x or more returns in successful startups |

Dividend yields of 3-6% (REITs), potential for MLP distributions |

Unaffected by market direction; aims for consistent returns |

| Recommended Investor Type |

Aggressive investors seeking high growth and willing to accept higher risk |

Investors seeking income while tolerating moderate risk |

Investors looking for market-neutral returns and risk diversification |

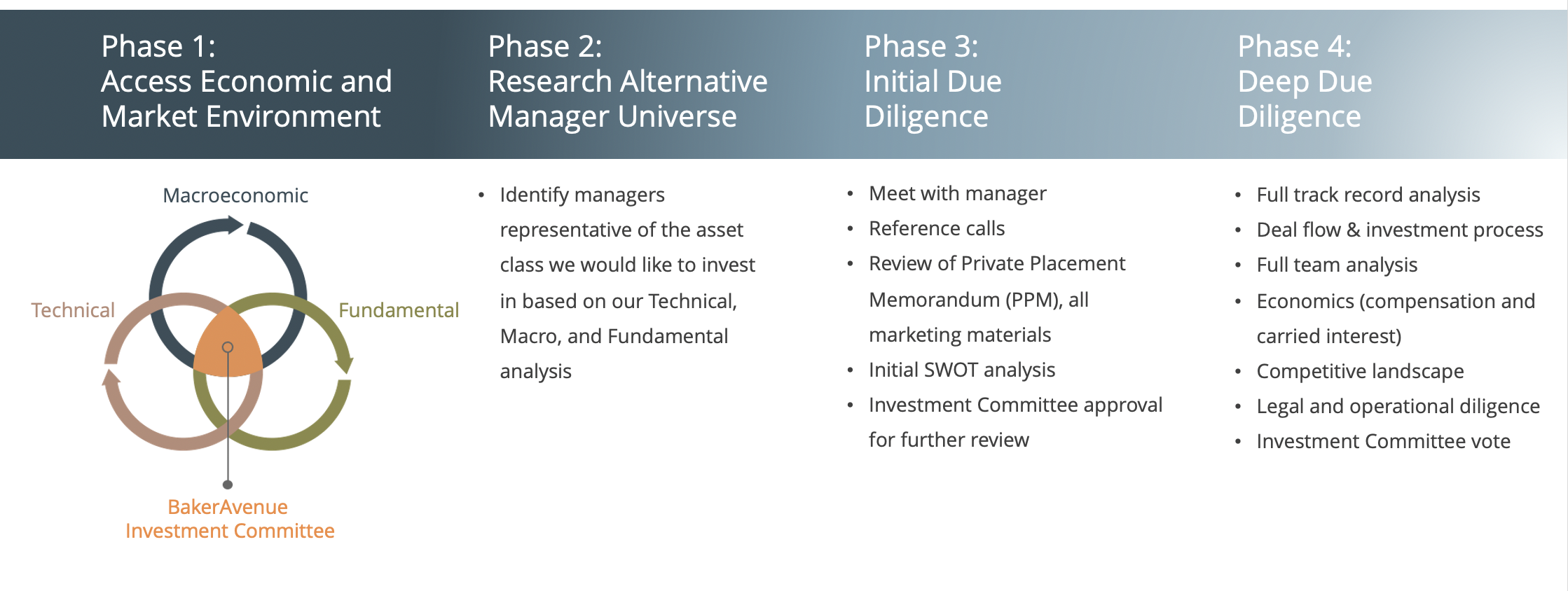

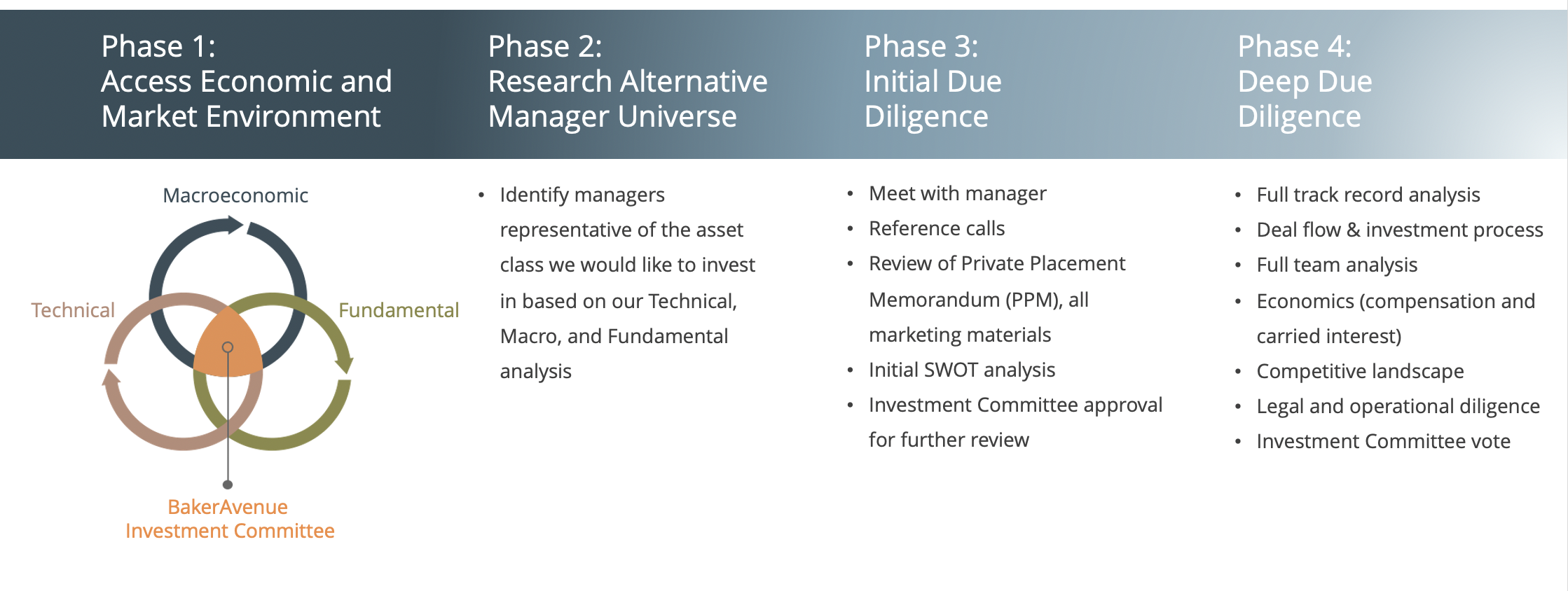

Our Due Diligence Process

BakerAvenue's four-phase process includes an extensive review of economic and market factors, plus stringent due diligence evaluation of various alternative managers.

We also consider the Four P's: People, Process, Philosophy, and Performance, in selecting our elite partners.

Risk Considerations

Alternative investments such as growth, income, and market-neutral solutions can offer unique opportunities for diversification and potential returns. However, they also come with their own set of risks and complexities. As asset managers, we tailor solutions based on your client's risk and return objectives.

It is crucial for investors to carefully assess their financial situation and investment goals before considering alternative investments. To navigate through the complexities and gain access to these investment options, consult with a BakerAvenue expert. Our experienced team can provide guidance and expertise to help your clients make informed investment decisions.

Please Note: Before considering Alternative Investments, review the following information and qualifications. Alternative Investments can offer unique opportunities, but they also involve significant risks. Being aware of these risks and your qualifications as an investor is crucial. Nature of Alternative Investments: Alternative Investments encompass a range of non-traditional assets, including private equity, hedge funds, real estate, and commodities. These investments often have distinct characteristics compared to traditional assets like stocks and bonds. They may involve longer investment horizons, less liquidity, and greater volatility. Risks Associated with Alternative Investments: Investing in Alternative Investments presents inherent risks that may not be suitable for all investors. These risks can include but are not limited to Lack of Liquidity: Alternative Investments are often less liquid than publicly traded securities, which means you may not be able to sell your investment when desired easily. Market Volatility: Alternative Investments can experience substantial price fluctuations due to market conditions, economic factors, or specific industry trends. Complexity: Many Alternative Investments require a deeper understanding of the underlying assets and strategies involved. Lack of Regulation: Some Alternative Investments may have limited regulatory oversight, which could lead to increased risks of fraud or mismanagement.

Qualifications for Alternative Investments: Risk Tolerance: Alternative Investments are typically riskier than traditional assets. Assess your risk tolerance and investment goals to determine if these investments align with your financial objectives. Financial Sophistication: Due to the complex nature of Alternative Investments, a certain level of financial sophistication and understanding is required. Investment Horizon: Alternative Investments often involve longer holding periods. Ensure your investment horizon matches the illiquid nature of these assets. Given the intricate nature of Alternative Investments, it's highly recommended to consult with qualified financial and investment professionals who specialize in alternative investments. While Alternative Investments can offer diversification and the potential for higher returns, they come with significant risks and require a thorough understanding. We encourage you to conduct thorough due diligence and seek professional advice before making any investment decision. Past performance is not indicative of future results. Your investment's value can fluctuate, and returns cannot be guaranteed.