November 2021: The BakerAvenue Prudence Indicator

BakerAvenue Prudence Indicator Says...

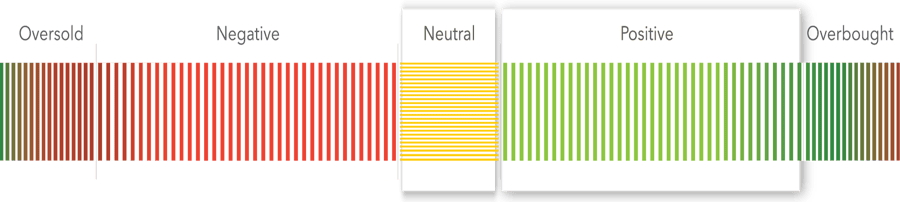

Long-term: Positive | Short-term: Neutral

Channeling Goldilocks

“It is always the simple that produces the marvelous.”

– Amelia Edith Huddleston Barr

The market narrative has quickly shifted from inflation-based (or stagflation-based) agitation to something more akin to a goldilocks scenario. Patient central banks have pushed back on the recent move higher in interest rates, while economic data is proving resilient and Q3 earnings keep coming in strong. The ‘not too hot (policy), not too cold (growth)’ backdrop continues to present a supportive market backdrop. What should investors watch for as we move into the final months of the year?

Markets perform best in a backdrop that is not too hot, and not too cold. The September selloff (worst month of the year for the S&P 500) was in part due to investor concern over restrictive Fed policy combined with slowing growth. October’s rebound (best month of the year for the S&P 500) was catalyzed by assurances from the Fed that they will remain accommodative (despite tapering bond purchases) and economic data that has continued to be resilient.

The delicate balance between factors contributing to the recovery (e.g. low interest rates) and potential hinderances of the recovery (e.g. higher inflation) is one to watch. Higher interest rates, commodity prices and, relatedly, inflation, has investors concerned that the symptoms of the economic recovery may be running ahead of the fundamentals. Interestingly, over the past year on days when those factors trend higher, the market has advanced. Why? Because higher interest rates, commodities and inflation also reflect economic vibrancy.

Although the fastest pace of the recovery now lies behind us, we expect strong growth in coming quarters, thanks to encouraging Covid trends, a consumption boost from pent-up saving, and inventory rebuilding. We believe higher interest rates are in store but will be accompanied by sustained growth. In short, a goldilocks backdrop supportive of a market that is at all-time highs.

At BakerAvenue, we maintain analytical independence from pre-written market narratives. We remove preconceived biases from the equation and defer to our analytical output. Ultimately, our views are only as optimistic or pessimistic as our technical, fundamental, and macro analyses indicate. Currently, our short-term metrics are in a neutral position. Long-term trends continue to paint a more optimistic picture (positive).

For those who have been following our weekly market updates (view previous market update videos and commentaries), you will be familiar with several of our key concerns and opportunities. For well over a year, we stated that the retrenchment in economic activity in 2020, while necessary, was self-inflicted, not structural, and prone to snapping back as re-opening resumed or vaccines entered the narrative. While we recognize a sustained expansion is quite different than the recent normalization, we suspect favorable policy decisions, economic growth, and earnings will continue to support a further grind higher in equities. Consolidations and pullbacks, should they occur during the final few weeks of the year, should be bought.

The Fundamental Perspective:

Fundamentally, we continue to focus on the trend in corporate profits and credit metrics. In aggregate, they remain healthy. Our weekly series for forward revenues, earnings, and margins all rose to record highs last month. Q3 earnings season has been strong with over 80% of companies beating estimates (with an average earnings surprise of over 10%!). Stubborn pricing pressure and supply constraints are headwinds, but strong demand has more than compensated. We continue to expect upside to consensus estimates but believe the frequency and magnitude of earnings and sales beats will moderate as we close out the year.

Valuations seem stretched in several pockets of the market but only slightly above long-term averages in others. The pace of the expansion in corporate profits has exceeded the price pace in stock prices in 2021, so multiples are now lower than they were at the start of the year. Valuation dispersion remains at record levels with a sizable gap between the secular growers and the more economically-sensitive recovery plays. We expect less dispersion going forward as investors embrace a more balanced view.

The credit backdrop remains supportive. Both investment-grade and high-yield spreads vs. Treasuries are back to pre-pandemic levels. Because continued tightening here is consistent with a rally in stocks, it has been encouraging to see. Dividend reinstatements (or increases) are now running well ahead of dividend cuts. As corporations’ confidence in their outlook continues to improve, we expect share buybacks and M&A to follow.

The Macro Perspective:

The macro discussion must start with a view on the global economic recovery. Incoming data over the past few weeks has supported our sustainable recovery narrative (e.g. unemployment reached 4.8% last month, a post-Covid low). Worries have centered on the mix of higher inflation, combined with slowing growth and the beginning of the Fed exit. While these certainly have our attention, we expect the inflation scare will subside as conditions generating price spikes ebb (e.g., bottlenecks ease, labor supply increases) and growth continues.

Interest rates will be the fulcrum by which investors express their economic growth views. We suspect they are somewhat distorted. Low-interest rates, a series of government support packages, a commitment by the Fed and other central banks, and highly accommodative fiscal policies have buffeted the pandemic shutdowns and laid the groundwork for the recovery. But things are slowly changing on the interest rate front. The Fed recently acknowledged that aggressive bond purchases are not a policy that fits well with a supply-constrained economy. Last month, they announced plans to taper those purchases (to help address inflation) while holding off on any rate hikes for an extended period (to aid growth). We expect rates to move gradually higher over time as the Federal Reserve pulls back QE and the economy continues to grow.

Regarding Covid, we are encouraged by the latest developments. Infections and, importantly, hospitalizations are trending lower and should continue to support the recovery trade. Recent drug announcements (e.g., Pfizer’s new pill) are providing additional catalysts. The high-frequency data we monitor (e.g. hotel occupancy rates, restaurant bookings, etc.) support the notion that the Delta-variant slowdown may be coming to an end. It is worth noting that we are in for an increasingly desynchronized recovery as vaccination rates vary globally. Nevertheless, we continue to expect US GDP growth to be the strongest in forty years.

The Technical Perspective:

The current technical backdrop remains in decent shape. Most major indices remain at, or very close to, all-time highs. Shallow pullbacks over the past couple months have done little to alter the longer-term trend. Longer-term moving averages (e.g. the 200-day moving average) remain in good standing with approximately 70% of stocks trading above this key threshold (a healthy level). Relative strength looks consistent with an economy that is in good shape (e.g. small caps broke out of a multi-month range, semiconductor stocks established renewed leadership, transports cleared resistance, etc.). Also, reopening stocks have been trouncing the pandemic winners recently.

Market breadth has improved a bit over the past few weeks, but there is more work to be done as the market remains a bit top-heavy. Currently, the top twenty companies in the S&P 500 make up over 40% of its market cap, and the top five over 25%. The “average stock” simply hasn’t kept pace with the largest, predominately technology, issues. We do expect a broadening market as we move into a more seasonally supportive backdrop.

Rotation within the market continues to be a weekly theme. Leadership has turned slightly more pro-cyclical of late (e.g. value, small caps, and commodity asset class are picking up relative strength), an encouraging sign. We do expect this churning behavior to continue as macro uncertainty remains. Investor sentiment is mixed with money flows into equities picking up but remaining well below those of bonds and cash. Since 2020, there has been over $2.4 trillion of inflows into bonds and cash vs. roughly $700 billion of inflows into equities (So, four times more inflows into cash and bonds!).

Concluding Thoughts:

We have championed a ‘barbell’ approach by investing with secular winners while simultaneously allocating capital toward assets that will benefit most in a recovery. We see no reason to change that view.

Systemic risks that could result in recessionary or bear market conditions remain low given the accompanying growth backdrop. Our forecast for a maturing but sustained economic expansion strengthens our belief that investor focus should be on “how” one is positioned, not “if” they should have exposure at all. That “how” should continue to include both secular growth and cyclical allocations.

Our investment philosophy is based on a dual mandate of growing, and protecting, client assets. With our cash positions now residual in nature, we are focusing on strategy positioning vs. our respective benchmarks to control risk. Should our base case hold, we plan to maintain our steady positioning. Of course, should the backdrop start to destabilize, we will take a more defensive stance.

Given the volatile and ever-changing backdrop, we believe a strategy that combines disciplined fundamental, technical, and macro analyses has the best chance of generating superior risk-adjusted returns. While our forecasts are subject to revision, our commitment to client service is rock solid. Should you have any questions please contact BakerAvenue, we are happy to share our thoughts in greater detail and welcome your questions or comments.

Disclosure: Past performance is not indicative of future performance.