February 2022: The BakerAvenue Prudence Indicator

BakerAvenue Prudence Indicator Says...

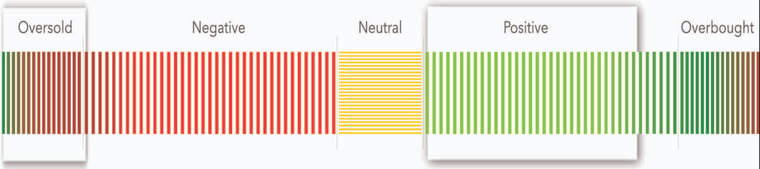

Long-term: Positive | Short-term: Oversold

Getting Comfortable With Being Uncomfortable

“Worry never robs tomorrow of its sorrow, it only saps today of its joy.”

– Leo Buscaglia

From monetary and fiscal policy headwinds to Covid and supply chain tailwinds, we continue to see 2022 as a transformational year. The capital markets are adjusting to a more normalized backdrop, and volatility is the uncomfortable companion going along for the ride. Encouragingly, the adjustments (e.g., interest rates, growth rates, valuations, etc.) are happening against a backdrop of strong economic growth and record corporate profitability. Investors are skeptical, but in time should get comfortable with the new backdrop.

Last month, we wrote that the winds of change are blowing, and investors should brace for an adjustment period. Specifically, the Fed’s shift towards tighter monetary policy (i.e., higher interest rates) would begin and capital markets would need to adjust to less accommodative financial conditions. In short order, bond yields have climbed back to pre-pandemic levels and asset class rotations, responding to those higher rates, have been sharp and volatile. The S&P 500 hit an all-time high on January 3rd of this year and has since corrected back towards its long-term trend line. The impact on longer-duration assets (e.g., long-term bonds, hyper-growth stocks, digital assets, etc.) has been more pronounced.

For the markets, two important considerations are 1) the pace of the adjustments and 2) the rationale behind them. For the last thirty years, declining interest rates have accompanied both rising equity valuations and higher corporate profit margins. The past couple of years were no exception. Central banks responded to the pandemic by flooding markets with liquidity and pushing the federal funds rate to zero. But now inflation is running well ahead of the Fed’s comfort level, and QE (e.g., buying of bonds to suppress rates) is coming to an end. A tightening cycle (rate increases) and QT (balance sheet runoff) is coming, and for the markets the pace is, well, uncomfortable.

The rationale behind the tighter policy should provide investors with some reassurance. Fed officials continue to acknowledge the strength in the economy with demand growth far outstripping supply (and, unfortunately, boosting inflation). And there are offsets to tighter policy. A consumption boost from pent-up savings and inventory rebuilding spurred on by improving supply chains can provide the necessary tailwinds to counter the tighter conditions.

Additionally, the backdrop seems more than capable of handling a less accommodative stance. The economy is on solid footing, the consumer is in good shape and corporate profits, which set records last year, should continue to expand well into 2022. It is worth noting that profit growth accounted for the entire S&P 500 return in 2021 (multiples went down). We expect another year of above-consensus growth. We acknowledge the volatility, but, for investors, it is time to get comfortable being uncomfortable.

At BakerAvenue, we maintain analytical independence from pre-written market narratives. We remove preconceived biases from the equation and defer to our analytical output. Ultimately, our views are only as optimistic or pessimistic as our technical, fundamental, and macro analyses indicate. Currently, our short-term metrics are bouncing off an oversold position, while long-term trends continue to paint a more optimistic picture (positive).

For those who have been following our market updates (view previous market update videos and commentaries), you will be familiar with several of our key concerns and opportunities. We have continually stated that the pandemic-related retrenchment in economic activity, while necessary, was self-inflicted, not structural, and prone to snapping back as re-opening resumed or vaccines entered the narrative.

While we recognize a sustained expansion is quite different than the recent normalization, we suspect another year of above-trend economic growth, robust consumer spending, inventory restocking, and double-digit earnings growth will be enough to offset monetary tightening and support a further grind higher in equities. The volatile start of the year has not changed that view. Consolidations and pullbacks are to be expected and, provided recessionary or bear market odds stay low, should be bought.

The Fundamental Perspective:

Fundamentally, we continue to focus on the trend in corporate profits and credit metrics. In aggregate, they remain healthy. Our weekly series for forward revenues, earnings, and margins have risen to record highs. Concerns about rising input costs have meant little to the robust trend in profit growth. In fact, corporate margins are higher now than they were pre-pandemic. We see more of the same in 2022 and expect earnings growth to again outpace economic growth. Stubborn pricing pressure and supply constraints are headwinds we are monitoring, but so far strong demand has more than compensated. While the frequency and magnitude of earnings and sales beats are normalizing, consensus estimates look beatable, and another double-digit expansion in profits is within reach.

Valuations have corrected and are now only slightly above long-term averages. The pace of the expansion in corporate profits has far exceeded stock prices over the past couple of years, so multiples are now lower than they were at this point last year. Valuation dispersion remains high with a sizable gap between the secular growers and the more economically sensitive recovery plays. Predictably, the backup in rates has caused this dispersion to shrink as the more speculative assets have corrected to a greater degree. We continue to see less dispersion going forward as investors embrace a more balanced view.

The credit backdrop remains supportive. Despite some widening over the past few weeks, both investment-grade and high-yield spreads vs. Treasuries remain near levels that are associated with strong equity markets. Dividend reinstatements (or increases) are running well ahead of dividend cuts. The record pace of deal activity in 2021 (e.g., IPO’s, M&A, etc.) looks to continue well into 2022 as cash flows remain strong and corporate confidence stays elevated.

The Macro Perspective:

The macro discussion must start with a view on the global economic recovery. Incoming data at the start of 2022 has supported our sustainable recovery narrative (e.g., unemployment reached a post-Covid low, retail sales remain strong, manufacturing reports are firmly in expansionary zones, etc.). Recent worries have centered on the mix of higher inflation, combined with slowing growth and the beginning of the Fed exit. While these certainly have our attention, we expect the inflation scare will subside as conditions generating the price spikes ebb (e.g., bottlenecks ease, labor supply increases) and economic growth continues. Real-time estimates for 2022 GDP growth are running around 5%, a slowdown from last year but ahead of long-term averages.

Interest rates will be the fulcrum by which investors express their economic growth views, and we continue to expect them to move gradually higher throughout the year. The Fed has acknowledged that aggressive bond purchases (QE) are not a policy that fits well with a supply-constrained economy. They recently announced plans to taper those purchases (to help address inflation), removing the largest suppressor of rates. Further, they recently adjusted their views by indicating inflation could stay longer than expected, and they could speed up its tapering process. We believe a faster taper (i.e., fewer bond purchases) is more of a capital market concern than an economic one, but if history is a guide, it will add to volatility.

Regarding Covid, we are encouraged by the latest developments. We continue to believe US shelter-in-place mandates are both socially and politically unsought and therefore lower the odds of a self-induced US recession. The high-frequency data we monitor (e.g., hotel occupancy rates, restaurant bookings, retail spending, etc.) support the notion that, while volatile, the recovery is intact. We do expect a mix-shift in spending in 2022 as pent-up services spending starts to outpace goods spending.

The Technical Perspective:

The technical backdrop is volatile. Longer-term, it remains in decent shape with most major indices remaining in an uptrend and hovering around key longer-term moving averages (e.g., the 200-day moving average). Admittingly, the corrections over the past few weeks have taken their toll on many of the short-term indicators we monitor. For example, the number of new lows has been outpacing the number of new highs, and several price change indicators are flagging a noticeable slowdown in momentum. We are on the lookout for some stability in these tactical reads.

The market is still a bit top-heavy, with the top twenty companies in the S&P 500 making up over 40% of its market cap and the top five over 25%. The “average stock” simply hasn’t kept pace with the largest, predominately technology, companies. We expect the market to broaden as we move further into 2022. Healthier markets tend to have strong participation rates, so we will be looking for improvement here. We are encouraged by the declining correlations we are seeing within sectors and industries. Lower correlations support a more active approach, an environment we welcome.

Rotation within market internals continues to be a weekly theme and has been quite pronounced to start the year. Leadership is bouncing back and forth between defensives and more economically sensitive groups as macroeconomic influence remains elevated. We expect this churning behavior to continue as long as macro uncertainty remains but see relative value in the groups less represented last year (e.g., small caps, value, economically sensitive groups, etc.).

Investor sentiment is quite bearish, which, from a contrarian point of view, is bullish. Surveys (e.g., AAII bull-bear survey, Investors Intelligence surveys, etc.) point to a skeptical investor base with the number of “bears” reaching the same levels as the pandemic peak (i.e., 45%, same as in March of 2020). Tactical positioning data (e.g., put-call ratios, cash balances, etc.) is leaning defensive and supports a short-term oversold view. Money has flown out of equities to start the year, reversing a multi-month trend selling bonds for stocks. Encouragingly, there is still almost $4 trillion in money market funds available to invest.

Concluding Thoughts:

We have championed a ‘barbell’ approach by investing with secular winners while simultaneously allocating capital toward assets that will benefit most in a recovery. We see no reason to change that view as we move deeper into the new year. We do believe the frequency by which investors can actively tilt portfolios towards those pockets of opportunity or away from risk will become more pronounced as the recovery matures.

Volatility should stay somewhat elevated, but systemic risks that could result in recessionary or bear market conditions remain low given the accompanying growth backdrop. Our forecast for a maturing but sustained economic expansion strengthens our belief that investor focus should be on “how” one is positioned, not “if” they should have exposure at all. That “how” should continue to include both secular growth and cyclical allocations.

Our investment philosophy is based on a dual mandate of growing and protecting client assets. With our cash positions now residual in nature, we are focusing on strategy positioning vs. our respective benchmarks to control risk. Should our base case hold, we plan to maintain our steady positioning. Of course, should the backdrop start to destabilize, we will take a more defensive stance.

Given the volatile and ever-changing backdrop, we believe a strategy that combines disciplined fundamental, technical, and macro analyses has the best chance of generating superior risk-adjusted returns. While our forecasts are subject to revision, our commitment to client service is rock solid.

Should you have any questions, please contact BakerAvenue. We are happy to share our thoughts in greater detail and welcome your questions or comments.

Disclosure: Past performance is not indicative of future performance.