December 2022: The BakerAvenue Prudence Indicator

BakerAvenue Prudence Indicator Says...

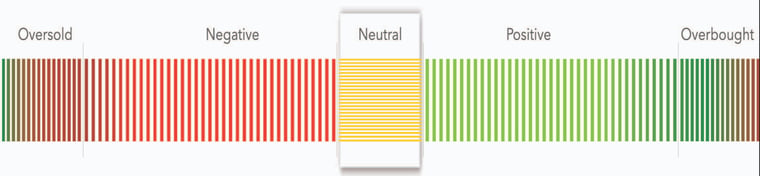

Long-term: Neutral | Short-term: Neutral

Positioning Amidst the Juxtapositions

“There will come a time when you believe everything is finished; that will be the beginning.”

– Louis L'Amour

Last month we wrote about how, given prospects for easing inflationary pressures, the Fed would have less need to tighten financial conditions at the pace they had been going. Also, we noted the seasonal setup is improving and sentiment remained cautious. Right on cue, Fed communication, while still vigilant regarding inflation, articulated a downshift in rate hikes (e.g., from 75 basis points to 50). November followed October’s bounce with a nice gain (e.g., the S&P 500 was up over 5% in November). The market’s best six-month seasonal stretch (e.g., November through April) is here, but we doubt seasonality alone will provide investors enough of a tailwind.

It is true that 2022 continues to be a year of macro and geopolitical shocks with sharply higher global rates and USD, stubbornly high inflation, China headwinds, and the largest conflict in Europe since WWII. Investors have responded to these events by devaluing many asset classes (e.g., the S&P 500 P/E as much as 7x while some speculative growth segments have crashed 70-80% from their highs). It is also true that investors are currently navigating several conflicting signals.

For example, the market is trading below long-term trendlines while at the same time market internals are showing improvement. Investor sentiment remains historically bad, but unemployment is near 50-year lows. Calls for at least a mild recession have grown louder while the US economy has accelerated (e.g., 4Q GDP looks to be +2.5%, 1Q was -1.6%). Profits have increased in 2022 while valuations cratered. A softening dollar (typically inflationary) doesn’t square with moderating inflation expectations. China, the world’s largest oil importer, is reopening their economy, yet crude is almost -40% off its high. We could go on.

It is common for markets to have competing signals, particularly at turning points. The vagaries of lag effects of market variables on different asset classes account for the bulk of the juxtaposition. But that doesn’t make it easy on investors. Confusing the picture even further in 2023 will be a policy shift from the Fed and unsettled geopolitical catalysts. Ultimately, however, investors need to pick a side in each inconsistency. We have sided with a positioning that acknowledges growth uncertainties, while continuing to believe the worst outcomes can be avoided. We have championed a ‘gloomy, but not doom(y)’ description, and remain committed to that view.

Among the variety of unintended consequences of financial repression and quantitative easing over the past decade or so, there is a more rigid belief in the efficient frontier when it comes to asset allocation. Such a strategy will work beautifully when interest rates are low and stable but may be more challenged when they are not. We believe active portfolio management can be an offset to this volatile outlook while providing optionality as we work through the market’s juxtapositions.

In times like these, it is important to have an investment process in place that removes emotion from the equation. At BakerAvenue, we maintain analytical independence from pre-written market narratives. We remove preconceived biases and defer to our analytical output. Ultimately, our views are only as optimistic or pessimistic as our technical, fundamental, and macro analyses indicate. Currently, both our short-term and long-term metrics are in a balanced (neutral) position.

For those who have been following our market updates (view previous market update videos and commentaries), you will be familiar with several of our key concerns and opportunities. We have continually stated that while growth is slowing, the downturn is more cyclical rather than secular. We do not forecast a break to our longstanding “growth normalization” view.

We do believe volatility will stay elevated, but ultimately, another year of economic and earnings growth should be enough to offset monetary tightening and support an eventual grind higher in equities. We want to be thoughtful regarding portfolio construction and risk control in these volatile times.

The Fundamental Perspective

Fundamentally, we continue to focus on the trend in corporate profits and credit metrics. Earnings takeaways over the past several weeks have reinforced our belief that, while the growth backdrop remains challenging, there are offsets. Headwinds like dollar strength and input cost pressure are slowly abating and are balanced by consumer spending resiliency and improving supply chain commentary. Our weekly series for forward revenues, earnings, and margins are well off their peak, but remain positive on a year-to-date basis. On balance, corporate results have matched expectations and provided some stalwart defense against any profit-recession narrative. While the frequency and magnitude of earnings and sales beats are normalizing, consensus estimates look reasonable.

Valuations have corrected and are now below long-term averages. The pace of the expansion in corporate profits has far exceeded stock prices over the past couple of years, so multiples are now well below where they were at this point last year. Valuation dispersion remains high with a sizable gap between the secular growers and the more economically sensitive stocks. Predictably, the backup in rates has caused this dispersion to shrink as the more speculative assets have corrected to a greater degree. We continue to see less dispersion going forward as investors embrace a more balanced view.

The credit backdrop will be important to monitor as growth concerns persist. One of the defining criteria between pronounced or shallow recessions has been the behavior of the credit markets. Both investment-grade and high-yield spreads vs. Treasuries are somewhat elevated but remain at non-recessionary levels. Corporate cash flows remain healthy with dividend reinstatements (or increases) running well ahead of dividend cuts.

The Macro Perspective

The macro discussion must start with a view on the global economy. Incoming economic data continues to support our slowing but not recessionary growth narrative (e.g., employment remains strong, manufacturing reports have stayed in expansionary zones, etc.). After two consecutive negative quarters to start the year, GDP growth seems to have bounced back to positive territory. Real time estimates forecast the best quarter of the year to be the last. Recent macro worries have centered on the mix of higher inflation, combined with slowing growth and tighter financial conditions (e.g., restrictive monetary policy). While these certainly have our attention, we expect the inflation scare will subside. Cooling input prices (e.g., transportation costs, used car prices, etc.) and easing supply chain pressures amid softening demand and tighter policy suggests inflation momentum has peaked.

Interest rates will be the fulcrum by which investors express their economic growth, inflation, and thus Fed policy, views. Yield curves have inverted as the front end of the curve has moved higher with the prospects of further rate hikes. Curve inversion should be respected, as they have a very strong track record in signaling recession over the past 40+ years. What they cannot predict accurately is the timing of the recession, nor its depth and magnitude. As mentioned, one of the most pressing questions for investors is: Can the Fed get control over inflation without causing a deep recession? It is going to be tricky, but at this point we believe they can.

The Technical Perspective

The technical backdrop remains choppy with the recent action keeping most benchmarks within a volatile trading range over the short term. While still tactically oversold, the range that has defined much of the last several months has still yet to be resolved. For example, the percentage of stocks trading above key moving averages (improving, but still low by historical standards) continues to indicate markets are fairly washed out. However, longer-term downtrends remain in place (e.g., most indices are below key long-term moving averages) and volatility has remained elevated. We are on the lookout for sustained stability in these metrics with a more balanced short-term outlook.

Despite the volatility, internal metrics have improved over the past couple months (e.g., expanding new highs vs. new lows, improving market breadth, etc.). Relative strength in more cyclically oriented pockets of the market is picking up vs. defensives, an encouraging sign. We expect the market to broaden and leadership to continue to adjust as we move into 2023. Healthier markets tend to have strong participation rates, so we will be looking for improvement here. We are encouraged by the higher performance dispersion within sectors and industries, as it supports more active oversight. We expect lower correlations will continue with macro-healing later in 2023, an environment we welcome.

Investor sentiment is still quite bearish, which, from a contrarian point of view, is bullish. Surveys (e.g., AAII bull-bear survey, Investors Intelligence surveys, Consumer Sentiment, etc.) point to a skeptical investor base with the number of “bears” still elevated. Tactical positioning data (e.g., put-call ratios, cash balances, etc.) is still leaning defensive and will act as a catalyst should the macro backdrop improve. While not the overriding factor, investor positioning often influences the order of magnitude in market moves (higher, or lower).

Concluding Thoughts

Despite the market inconsistencies, we see little reason to change our outlook. We have championed an active approach of investing with secular winners while simultaneously allocating capital toward assets that will benefit most in a recovery. We do believe the frequency by which investors can actively tilt portfolios towards those pockets of opportunity or away from risk will become more pronounced as growth slows.

Volatility should stay elevated given the macro uncertainties. Systemic risks that could result in prolonged recessionary or bear market conditions exist, but are not overwhelming, given the accompanying growth backdrop. Our forecast for a maturing but sustained economic expansion strengthens our belief that investor focus should be on “how” one is positioned, not “if” they should have exposure at all.

Our investment philosophy is based on a dual mandate of growing and protecting client assets. We are staying active, using the volatility to harvest losses while opportunistically deploying capital where appropriate. We have lowered our cash weightings and are focusing on strategy positioning vs. our respective benchmarks to control risk. Of course, should the backdrop destabilize, we will take a more defensive stance.

Should you have any questions, please contact BakerAvenue. We are happy to share our thoughts in greater detail and welcome your questions or comments.

Disclosure: Past performance is not indicative of future performance.